IN WCE-1 2009 free printable template

Show details

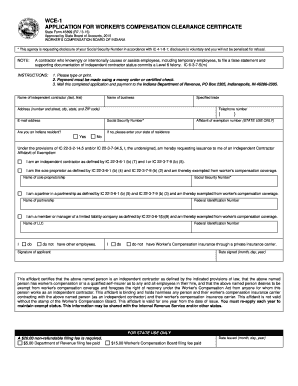

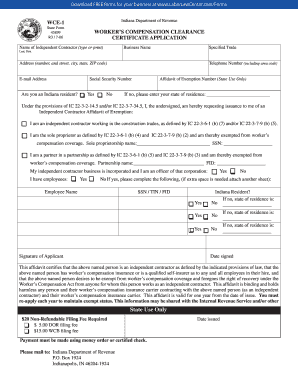

Reset Form WCE-1 APPLICATION FOR WORKER S COMPENSATION CLEARANCE CERTIFICATE State Form 45899 R6 / 12-09 Indiana Department of Revenue / Worker s Compensation Board of Indiana INSTRUCTIONS Please type or print. Payment must be made using a money order or certified check. FOR STATE USE ONLY A 20. 00 non-refundable filing fee is required. 5. 00 Department of Revenue filing fee paid Date issued month day year 15. 00 Worker s Compensation Board filin...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN WCE-1

Edit your IN WCE-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN WCE-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN WCE-1 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IN WCE-1. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN WCE-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN WCE-1

How to fill out IN WCE-1

01

Begin by downloading the IN WCE-1 form from the relevant government website.

02

Review the instructions provided with the form carefully.

03

Fill in your personal details in the designated sections, including your name, address, and contact information.

04

Provide information related to your employment history, including the name of your employer, position held, and duration of employment.

05

Complete any financial information requested, ensuring that it is accurate and up to date.

06

Attach any required documents, such as identification or proof of employment, as specified in the instructions.

07

Review the completed form for any errors or missing information before submission.

08

Submit the form to the designated office either online or via mail, based on the submission guidelines provided.

Who needs IN WCE-1?

01

Individuals who are applying for a certain government benefit or program that requires an assessment of their work experience.

02

Employers who need to verify the work history of potential employees using the form for background checks.

03

Anyone seeking to provide documented proof of their employment and related credentials for various official purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the coming and going rule in Indiana?

Under the “coming and going” rule, generally, if an employee is injured while commuting to and from a fixed site of employment at the beginning or end of his or her shift, this would not be a workers' compensation injury. The “coming and going” rule ends once the employee reaches the employer's premises.

What is the maximum TTD rate in Indiana?

TTD benefits are calculated as two-thirds of the worker's average weekly wage during the year before the injury occurred. In Indiana, the maximum average weekly wage for determining benefits is $1,170 (as of 2020). That equates to a maximum TTD benefit of $780 per week.

What is maximum medical improvement in Indiana?

Indiana courts call it the point in which a worker has achieved the fullest reasonably expected recovery with respect to a work related injury. Indiana doctors use MMI to indicate that an injured worker no longer requires medical care that will improve his/her condition.

Is workers compensation insurance required in Indiana?

A: The law requires most businesses to have worker's compensation insurance. If you are injured while working at your job, you may be entitled to workers' compensation benefits. Q: When should I report an accident that happened on the job?

How to get workers compensation insurance in Indiana?

Workers' Compensation Insurance in Indiana can be purchased from private insurance companies authorized by the state to provide coverage. The Assigned Risk Pool, or an alternate State Insurance Fund, is available for businesses that are unable to find coverage from a private company.

What is the TTD rate in Indiana?

The value of TTD benefits owed is set by Indiana Worker's Compensation Law. It's two-thirds (2/3) of the injured employee's average weekly wage (AWW).

How do I apply for workers comp in Indiana?

How to File a Workers' Compensation Claim in Indiana Step-by-step process for filing a workers' comp claim. Step #1: Seek medical attention. Step #2: Notify your employer. Step #3: Make certain your employer files the necessary form. Step #4: Wait to receive a decision from the insurance company.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IN WCE-1 for eSignature?

IN WCE-1 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete IN WCE-1 online?

pdfFiller has made it easy to fill out and sign IN WCE-1. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for signing my IN WCE-1 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your IN WCE-1 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is IN WCE-1?

IN WCE-1 is a form used for reporting certain financial and identification information to the relevant authorities in the context of business operations.

Who is required to file IN WCE-1?

Entities and businesses that meet specific regulatory criteria related to their operations or financial status are required to file IN WCE-1.

How to fill out IN WCE-1?

To fill out IN WCE-1, individuals or entities should carefully follow the guidelines provided in the form instructions, ensuring that all required fields are completed accurately.

What is the purpose of IN WCE-1?

The purpose of IN WCE-1 is to collect essential financial and operational data for monitoring, compliance, and policy-making by relevant authorities.

What information must be reported on IN WCE-1?

Information that must be reported on IN WCE-1 typically includes financial metrics, identification details of the entity, and other regulatory compliance data.

Fill out your IN WCE-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN WCE-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.